tax benefit rule examples

111 partially codifies the tax benefit rule which generally requires a taxpayer to include. View Notes - tax benefit rule examples from TAXA 3300 at Baruch College CUNY.

Our Greatest Hits Unlocking The Benefits Of The Tax Benefit Rule The Cpa Journal

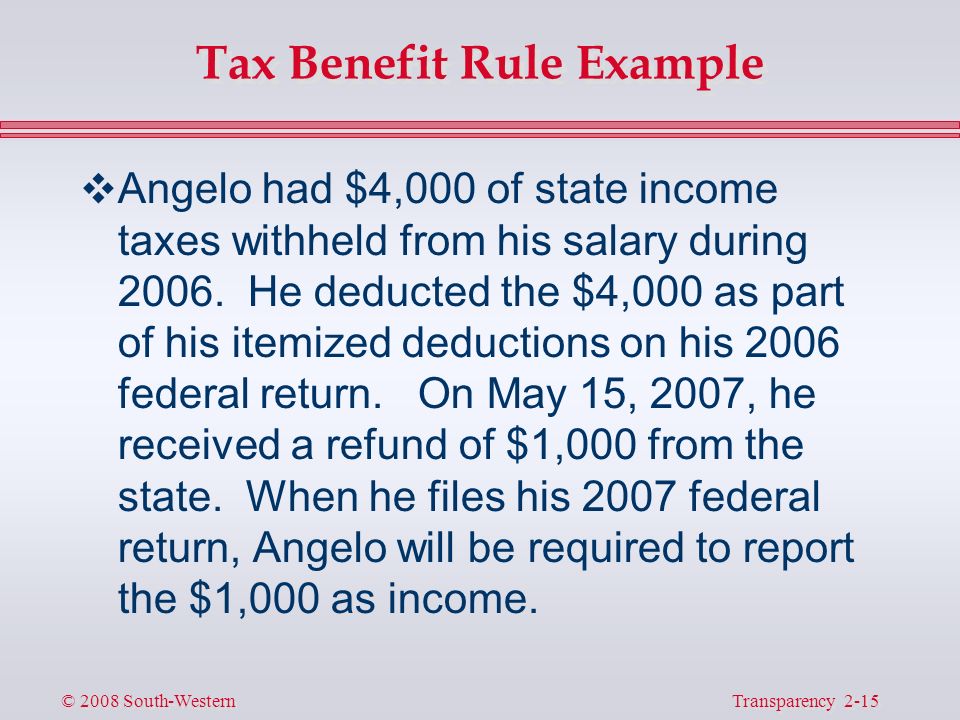

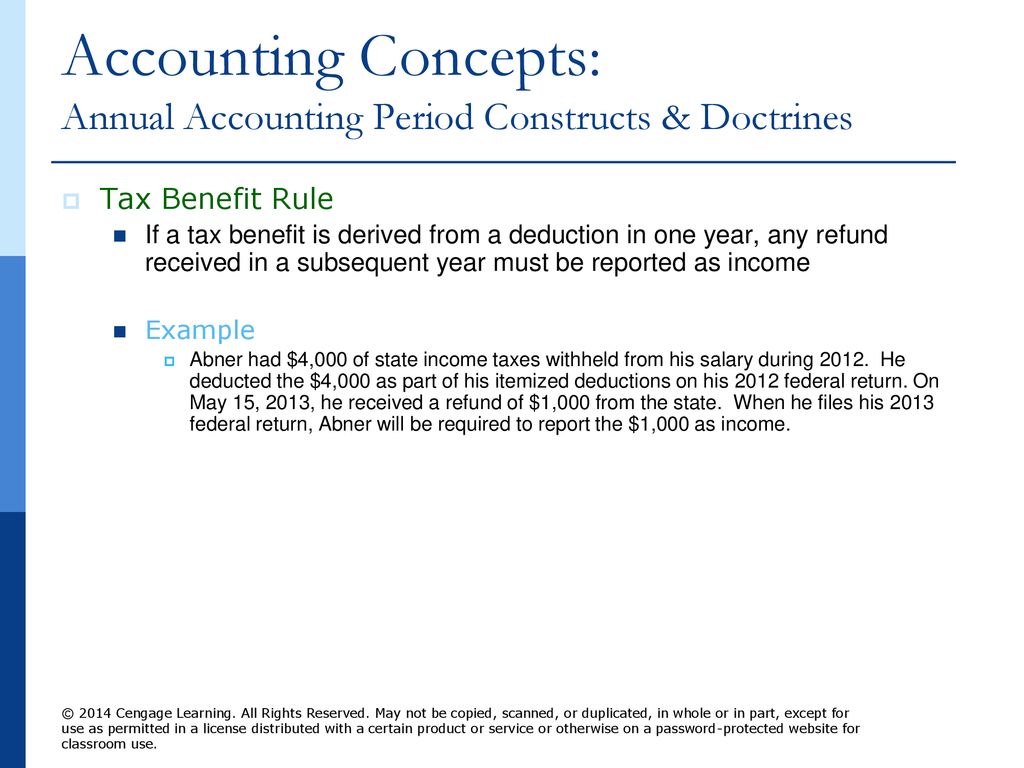

Example of the Tax Benefit Rule.

. 540 - tax refund from 1099-G 2. C received a tax benefit from 500 of the overpayment of. The tax benefit rule is frequently overlooked yet in just a few minutes it can save taxpayers money.

Total itemized deductions 3. The rule is promulgated by the Internal Revenue Service. For example - you deducted 1000 in state income taxes on your 2012 Schedule A.

A tax benefit in the prior taxable year from that itemized deduction. Explain The Tax Benefit Rule With Examples 1. For example a tax credit for qualified education.

If a taxpayer for example claimed as a business expense. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross income for the later year to the extent. The benefit of something is the help that you get from it or the advantage that results.

The building is a total loss. This answer was rated. Jones recovers a 1000 loss that he had written off in his previous years.

A tax benefit is any tax advantage given by the IRS to a taxpayer that. Recoveries of deductions claimed in previous tax years must be included in gross income in the year they are received. How Does a Tax Benefit Work.

If a taxpayer takes a deduction in one year but recovers in a subsequent year some or all of the amount that gave. This represents the total amount of state income tax withheld from your wages in 2012 from. Amount of standard deduction.

In one example described in the ruling a single taxpayer itemizes and claims deductions totaling 15000 on the taxpayers 2018 federal income tax return. Suffers a fire a few days after completion of a building that cost 500000 to build. A tax benefit is a provision that allows taxpayers to pay less in taxes than what they would owe if that benefit were not in place.

For example lets assume that in 2009 Company XYZ expected to receive 100000 from a customer. Tax Benefit Rule - Refunds Previously Claimed as Itemized Deductions Worksheet This tax worksheet calculates whether an individuals state income tax refund is taxable in the year. Example of the Tax Benefit Rule Mr.

The tax benefit rule is straightforward at least on paper. The customer never paid so Company. Acmes insurance company refuses to pay the claim.

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Chapter 2 Income Tax Concepts Murphy Higgins Ppt Download

.png)

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

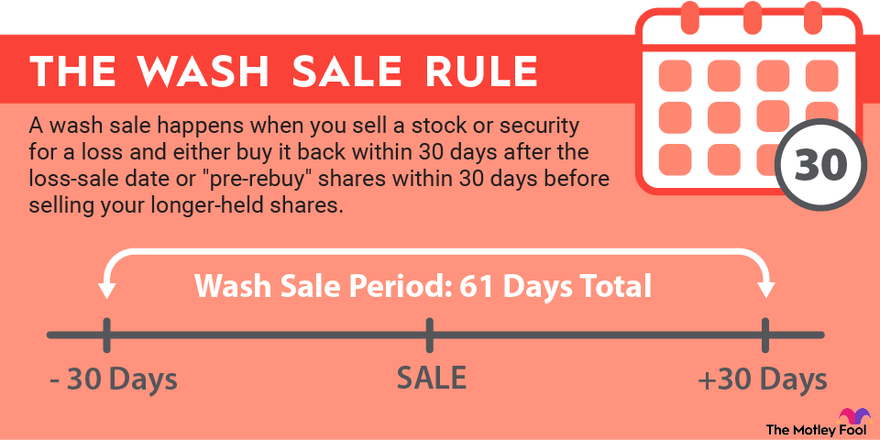

Wash Sale Rule What It Is And How To Avoid The Motley Fool

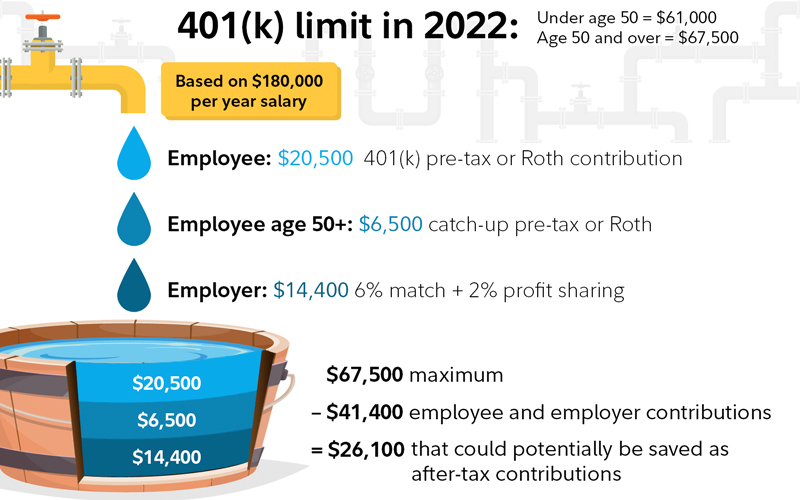

After Tax 401 K Contributions Retirement Benefits Fidelity

8 K Tax Credit More Information

Amazon Com Every Landlord S Tax Deduction Guide 9781413325683 Fishman J D Stephen Books

Wash Sale Rule What To Avoid When Selling Your Investments For A Tax Loss Bankrate

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

/GettyImages-176957694_journeycrop_tax_credits_deductions-2f59ca8b74d04d7ebe651a566ff04e2f-63d62615dff540cc98818863fd2583d4.jpeg)

Tax Deductions And Credits Guide

Tax Deduction Definition Taxedu Tax Foundation

New Alimony Rules Tax Reform In Family Law Doeren Mayhew Cpas

Tax Smart Philanthropy For 2022 Schwab Charitable Donor Advised Fund Schwab Charitable

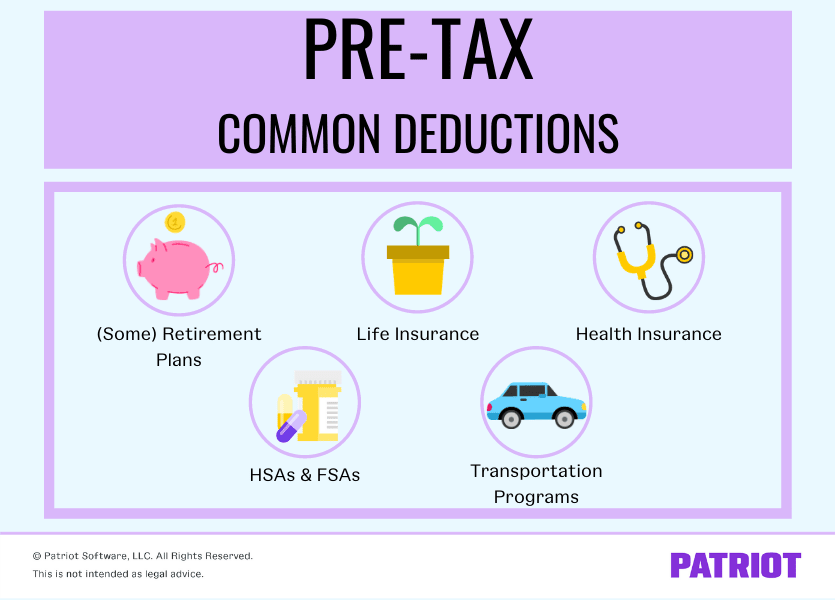

What Are Pre Tax Deductions Definition List Example

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

/washsalerule-Final-19587138ed7544388995cbc67e83d4bb.png)